Spread Market Maker Profit . They earn profits from the spread between bid and ask prices and from. market makers provide liquidity and transparency to various markets, such as u.s. Generally, the market maker will buy securities for less than the current quote price and sell for more than the current quote price. Learn how it impacts trading costs, market liquidity,. the market maker spread is the difference between the price a market maker offers to buy a security for and the price they offer to sell it for. Cash equities, fixed income, foreign. Find out the difference between market makers and. They buy securities at the bid price (the highest price a buyer is willing to pay) and sell them at the ask price (the lowest price a seller is willing to accept).

from marketbusinessnews.com

Generally, the market maker will buy securities for less than the current quote price and sell for more than the current quote price. Find out the difference between market makers and. They buy securities at the bid price (the highest price a buyer is willing to pay) and sell them at the ask price (the lowest price a seller is willing to accept). Learn how it impacts trading costs, market liquidity,. the market maker spread is the difference between the price a market maker offers to buy a security for and the price they offer to sell it for. market makers provide liquidity and transparency to various markets, such as u.s. Cash equities, fixed income, foreign. They earn profits from the spread between bid and ask prices and from.

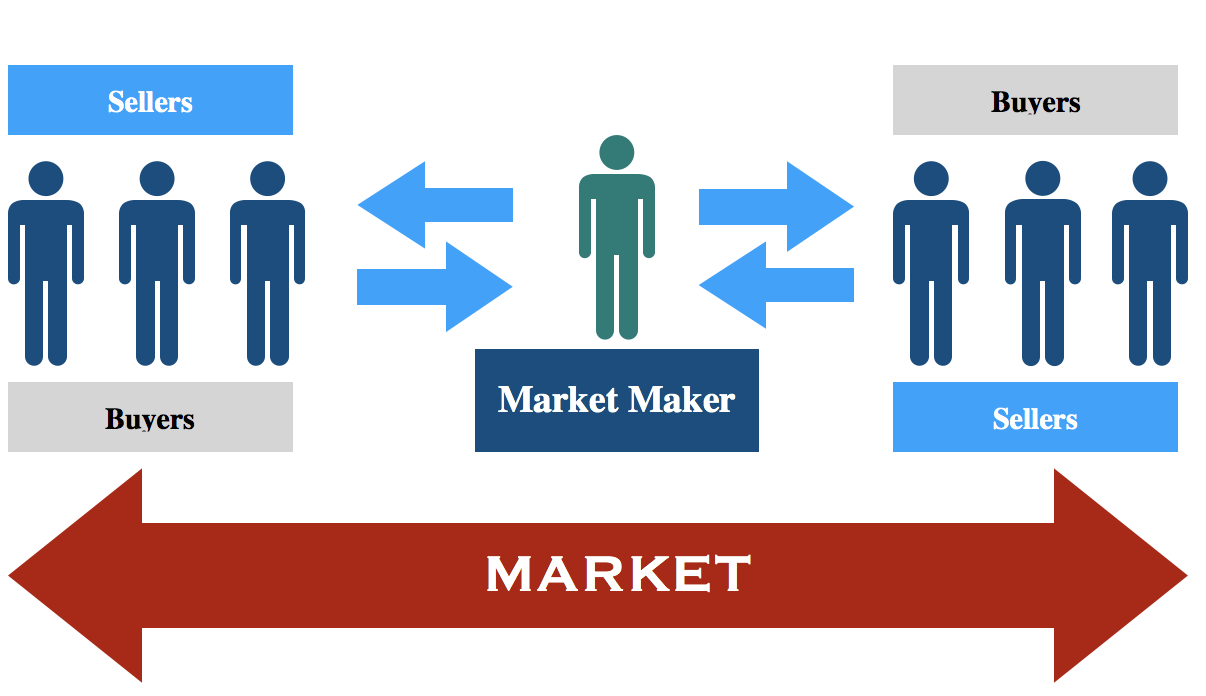

What is a market maker? Definition and meaning Market Business News

Spread Market Maker Profit Generally, the market maker will buy securities for less than the current quote price and sell for more than the current quote price. Learn how it impacts trading costs, market liquidity,. Find out the difference between market makers and. They earn profits from the spread between bid and ask prices and from. market makers provide liquidity and transparency to various markets, such as u.s. Generally, the market maker will buy securities for less than the current quote price and sell for more than the current quote price. the market maker spread is the difference between the price a market maker offers to buy a security for and the price they offer to sell it for. They buy securities at the bid price (the highest price a buyer is willing to pay) and sell them at the ask price (the lowest price a seller is willing to accept). Cash equities, fixed income, foreign.

From openclipart.org

Clipart Profit Chart Curve Spread Market Maker Profit Find out the difference between market makers and. They buy securities at the bid price (the highest price a buyer is willing to pay) and sell them at the ask price (the lowest price a seller is willing to accept). Cash equities, fixed income, foreign. market makers provide liquidity and transparency to various markets, such as u.s. the. Spread Market Maker Profit.

From speedtrader.com

ECNs and Market Makers What You Should Know Spread Market Maker Profit Find out the difference between market makers and. They earn profits from the spread between bid and ask prices and from. Generally, the market maker will buy securities for less than the current quote price and sell for more than the current quote price. They buy securities at the bid price (the highest price a buyer is willing to pay). Spread Market Maker Profit.

From get.exness.help

What is a market maker? Exness Help Center Spread Market Maker Profit Cash equities, fixed income, foreign. Find out the difference between market makers and. They earn profits from the spread between bid and ask prices and from. Generally, the market maker will buy securities for less than the current quote price and sell for more than the current quote price. the market maker spread is the difference between the price. Spread Market Maker Profit.

From broex.io

What is spread and slippage in trading? Market Makers and Spread Spread Market Maker Profit the market maker spread is the difference between the price a market maker offers to buy a security for and the price they offer to sell it for. They earn profits from the spread between bid and ask prices and from. market makers provide liquidity and transparency to various markets, such as u.s. Find out the difference between. Spread Market Maker Profit.

From www.thebalancemoney.com

What Is a Market Maker? Spread Market Maker Profit Find out the difference between market makers and. They buy securities at the bid price (the highest price a buyer is willing to pay) and sell them at the ask price (the lowest price a seller is willing to accept). They earn profits from the spread between bid and ask prices and from. market makers provide liquidity and transparency. Spread Market Maker Profit.

From fxssi.com

Market Makers Their Point of View on the Market FXSSI Forex Spread Market Maker Profit Learn how it impacts trading costs, market liquidity,. They earn profits from the spread between bid and ask prices and from. Find out the difference between market makers and. market makers provide liquidity and transparency to various markets, such as u.s. the market maker spread is the difference between the price a market maker offers to buy a. Spread Market Maker Profit.

From www.youtube.com

Market Maker Profit Cycle in Forex Market by Michael Abera YouTube Spread Market Maker Profit Find out the difference between market makers and. They earn profits from the spread between bid and ask prices and from. Cash equities, fixed income, foreign. Learn how it impacts trading costs, market liquidity,. market makers provide liquidity and transparency to various markets, such as u.s. Generally, the market maker will buy securities for less than the current quote. Spread Market Maker Profit.

From www.skillsuccess.com

Options Trading Course How To Trade For Weekly Profits Skill Success Spread Market Maker Profit Cash equities, fixed income, foreign. Learn how it impacts trading costs, market liquidity,. They buy securities at the bid price (the highest price a buyer is willing to pay) and sell them at the ask price (the lowest price a seller is willing to accept). They earn profits from the spread between bid and ask prices and from. Find out. Spread Market Maker Profit.

From slideplayer.com

Understanding Markets and Industry Changes ppt download Spread Market Maker Profit the market maker spread is the difference between the price a market maker offers to buy a security for and the price they offer to sell it for. Generally, the market maker will buy securities for less than the current quote price and sell for more than the current quote price. They buy securities at the bid price (the. Spread Market Maker Profit.

From www.youtube.com

Market Makers Trading Strategy How Market Makers Earn Profits YouTube Spread Market Maker Profit market makers provide liquidity and transparency to various markets, such as u.s. They earn profits from the spread between bid and ask prices and from. Generally, the market maker will buy securities for less than the current quote price and sell for more than the current quote price. Learn how it impacts trading costs, market liquidity,. Find out the. Spread Market Maker Profit.

From www.youtube.com

Market Maker Liquidity And How It Drives The Market YouTube Spread Market Maker Profit They earn profits from the spread between bid and ask prices and from. Cash equities, fixed income, foreign. Find out the difference between market makers and. the market maker spread is the difference between the price a market maker offers to buy a security for and the price they offer to sell it for. Generally, the market maker will. Spread Market Maker Profit.

From medium.com

Inside Quant Trading The Market Maker Algorithm. by HyperQuant Spread Market Maker Profit Generally, the market maker will buy securities for less than the current quote price and sell for more than the current quote price. the market maker spread is the difference between the price a market maker offers to buy a security for and the price they offer to sell it for. They buy securities at the bid price (the. Spread Market Maker Profit.

From get.exness.help

Understanding Market Makers Exness Help Center Spread Market Maker Profit Cash equities, fixed income, foreign. They buy securities at the bid price (the highest price a buyer is willing to pay) and sell them at the ask price (the lowest price a seller is willing to accept). market makers provide liquidity and transparency to various markets, such as u.s. Find out the difference between market makers and. They earn. Spread Market Maker Profit.

From zipmex.com

What Is A Market Maker? How Does It Provide Liquidity To The Market Spread Market Maker Profit market makers provide liquidity and transparency to various markets, such as u.s. Cash equities, fixed income, foreign. Learn how it impacts trading costs, market liquidity,. They earn profits from the spread between bid and ask prices and from. Generally, the market maker will buy securities for less than the current quote price and sell for more than the current. Spread Market Maker Profit.

From academy.shrimpy.io

What is Market Spread? Spread Market Maker Profit market makers provide liquidity and transparency to various markets, such as u.s. Find out the difference between market makers and. the market maker spread is the difference between the price a market maker offers to buy a security for and the price they offer to sell it for. They earn profits from the spread between bid and ask. Spread Market Maker Profit.

From quantmatter.com

How Do We Gain Profit as Market Makers? Quant Matter Spread Market Maker Profit market makers provide liquidity and transparency to various markets, such as u.s. the market maker spread is the difference between the price a market maker offers to buy a security for and the price they offer to sell it for. They earn profits from the spread between bid and ask prices and from. Learn how it impacts trading. Spread Market Maker Profit.

From www.youtube.com

MARKET MAKER SELL MODEL ( HOW TO TRADE AND ANTICIPATE A SELL MODEL Spread Market Maker Profit Cash equities, fixed income, foreign. Generally, the market maker will buy securities for less than the current quote price and sell for more than the current quote price. the market maker spread is the difference between the price a market maker offers to buy a security for and the price they offer to sell it for. They buy securities. Spread Market Maker Profit.

From thetradingbible.com

Bid and Ask in Trading Differences Explained Spread Market Maker Profit Learn how it impacts trading costs, market liquidity,. They buy securities at the bid price (the highest price a buyer is willing to pay) and sell them at the ask price (the lowest price a seller is willing to accept). Generally, the market maker will buy securities for less than the current quote price and sell for more than the. Spread Market Maker Profit.